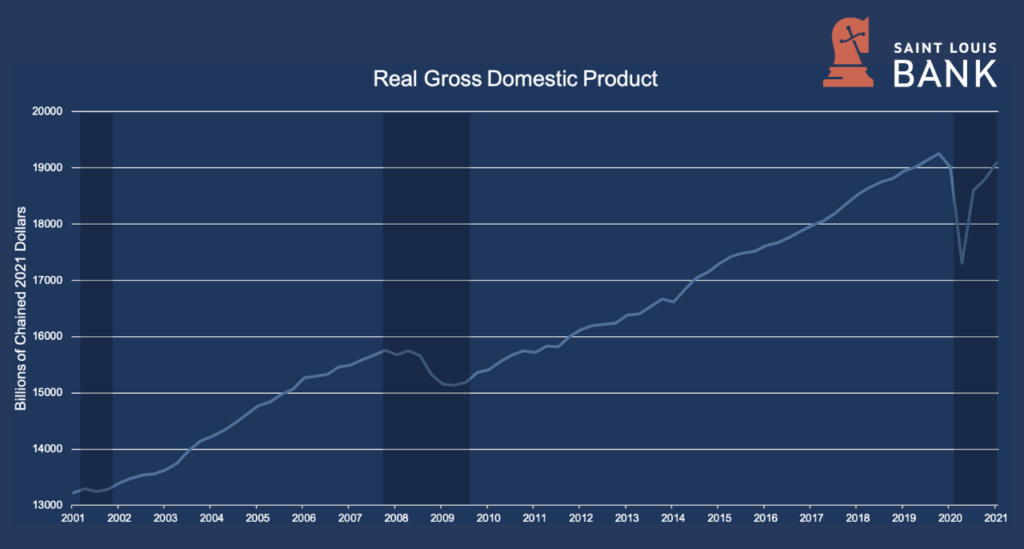

After over a year of devastating shocks and setbacks, the U.S. economy appears poised to recover with gross domestic product (“GDP”) expectations at levels surpassing what was expected before the pandemic. While it appears as though the U.S. has not only avoided the “scarring” that many economists feared at the beginning of the pandemic, but there has also been an acceleration of technology change, meaning that productivity growth, and GDP, may remain above pre-pandemic levels. That said, it is believed that the recovery will be uneven, with some sectors facing structural changes and some companies facing challenges to adapt.

Some reasons behind why the economy is poised for strong growth:

Real gross domestic product is the inflation-adjusted value of the goods and services produced by labor and property located in the United States. Shading indicates U.S. recessions, the most recent one is ongoing.

The positive picture of the economy comes with structural changes that will challenge some sectors. Although business spending is expected to be reasonably strong, investment in structures—especially office and retail buildings—is likely to lag. Instead, it is forecasted that businesses will double down on technology investment, buying equipment and software to support more virtual work. Additionally, growing e-commerce will mean growing demand for light vehicles and medium-weight trucks for delivery services along with a demand for drivers, gasoline, and related products.

The pandemic’s long-term impacts may take many forms, positive and negative, and will likely continue to surprise us. There are many issues that will affect national and local economic conditions including inflation risk, potential changes in the taxation of corporations, vaccination levels, and vaccine distribution in different parts of the world. As we review some of the fundamentals, we continue to believe there is a heightened risk level given the large unknowns remaining. However, many indicators evidence sound trajectories for recovery.

On a regional level, economic conditions have continued to improve at a moderate pace per the July 2021 Eighth District Beige Book published by the Federal Reserve Bank (“FRB”). Per the publication, which covers the Eighth District that includes St. Louis, Little Rock, Louisville and Memphis, labor and material shortages are restraining some companies in meeting customer demand. Overall, cost pressures remain elevated, with varying degrees of pass-through to customers. Reports on consumer spending continue to be strong, although inventory shortages are restraining auto sales. Real estate sales remained high across many real estate types despite strong price growth and low inventories. Banks reported slight improvements in loan demand and stable credit quality. District agriculture conditions remain favorable when compared to previous years.

Many FRB contacts across the District continued to face worker shortages and high turnover rates for recent hires. Firms reported increasing benefits, introducing greater flexibility, and lowering job requirements in order to attract workers. In the wake of several states cutting or planning to cut federal unemployment aid; some companies are reporting seeing a clear increase in applicants, while others reported no substantial change thus far. Wages have grown moderately; however, wage growth has been strong for low-wage positions as a consequence of the tight labor market. Many FRB contacts emphasized raising wages for both new and existing employees while turnover remains high.

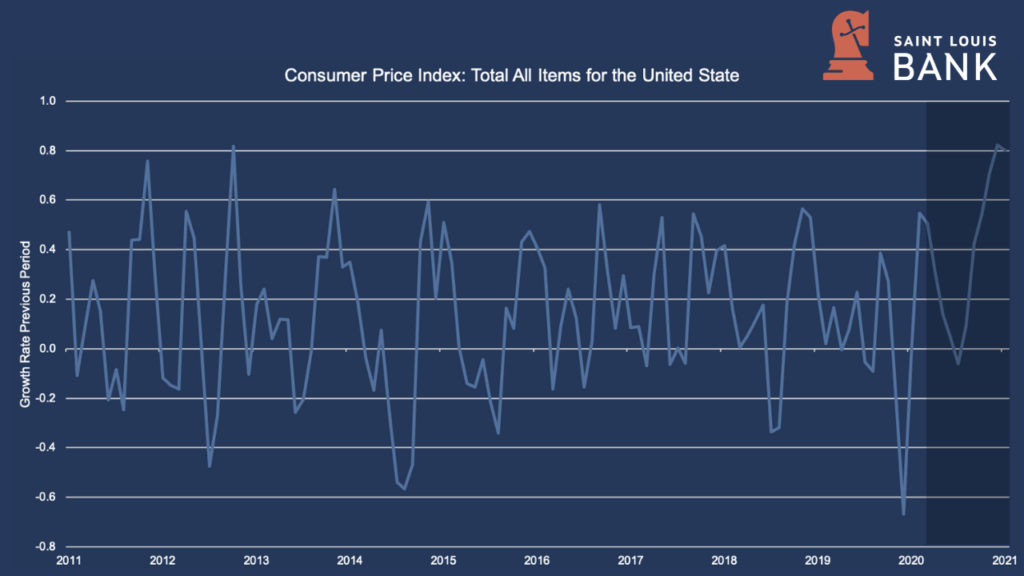

The pass-through rate of cost increases varies by industry. Much of the cost pressures are due to increased demand for inputs and a lagging supply chain. Business with more purchasing power have been able to keep prices steady, but smaller and newer companies are experiencing robust cost increases with a more immediate need to pass those increases on to consumers. For the travel and hospitality industry, the ability to pass price increases to consumers is largely due to strengthening demand for travel and hospitality services. Prices for raw materials have been down moderately overall, with the exceptions of steel, shredded scrap, and coal. As shown in the graph below, the consumer price index has shown a steady increase since November 2020 and most significantly since April 2020 with the highest level reported in the 10 years of data shown in April 2021.

Indication of Consumer Price Index from the Organization for Economic Co-operation and Development. Shading indicates U.S. recessions, the most recent one is ongoing.

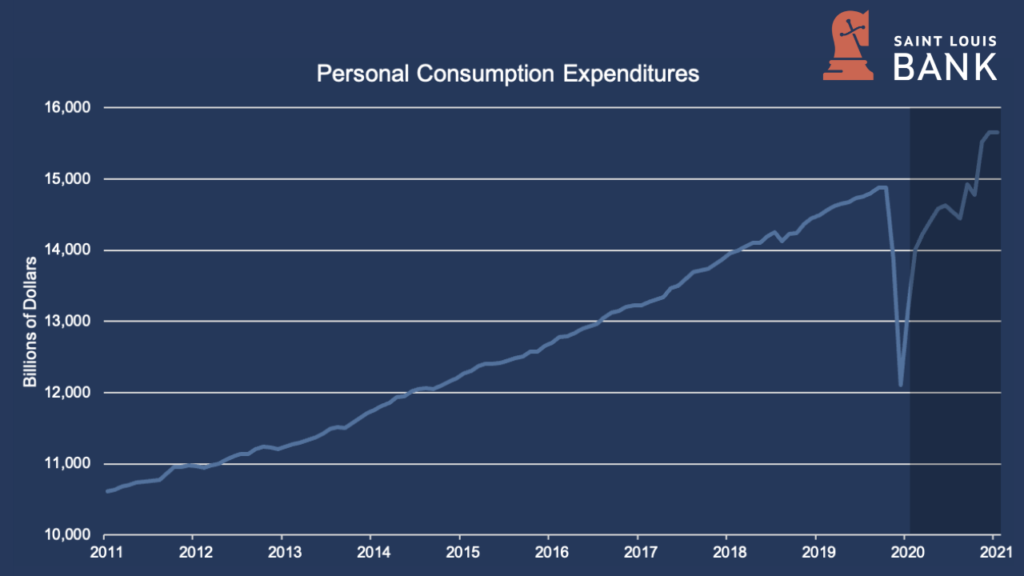

This is an indicator that the consumer is accepting the current price trends with the highest period of expenditures over the last 10-year timeframe occurring in recent months.

In Billions of Dollars, Seasonally Adjusted Annual Rate; Shading indicates U.S. recessions, the most recent one is ongoing.

District general retailers, auto dealers, and hospitality contacts of the FRB continue to report strong consumer spending activity with general retailers continuing to report strong business activity and a positive outlook. District auto dealers reported no change in sales but continued high demand and decreasing inventory levels for both new and used vehicles. The hotel industry is reporting that leisure travel has been stronger than expected and has made progress in offsetting the lagging business travel.

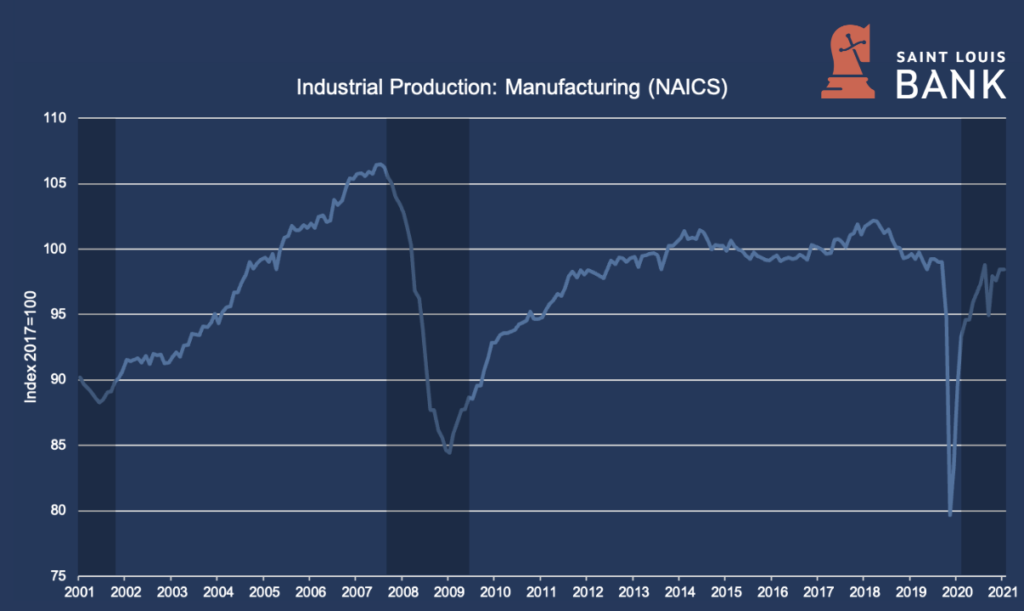

Firms report upticks in new orders and production, although the rate of growth has slightly declined. Supply-chain-related cost pressures and product shortages remain high, and manufacturers in the area expect these difficulties to continue for several months. Like other sectors, FRB manufacturing contacts reported that they are still struggling to find and retain employees.

The following chart shows production in the manufacturing sector for the past 20 years. It is noted that since the recent low point reported in April 2020, production levels spiked in January 2021 and are currently on an upward trajectory.

Seasonally adjusted Manufacturing Production, Nationally. Shaded areas indicate U.S. recessions, the most recent one is ongoing.

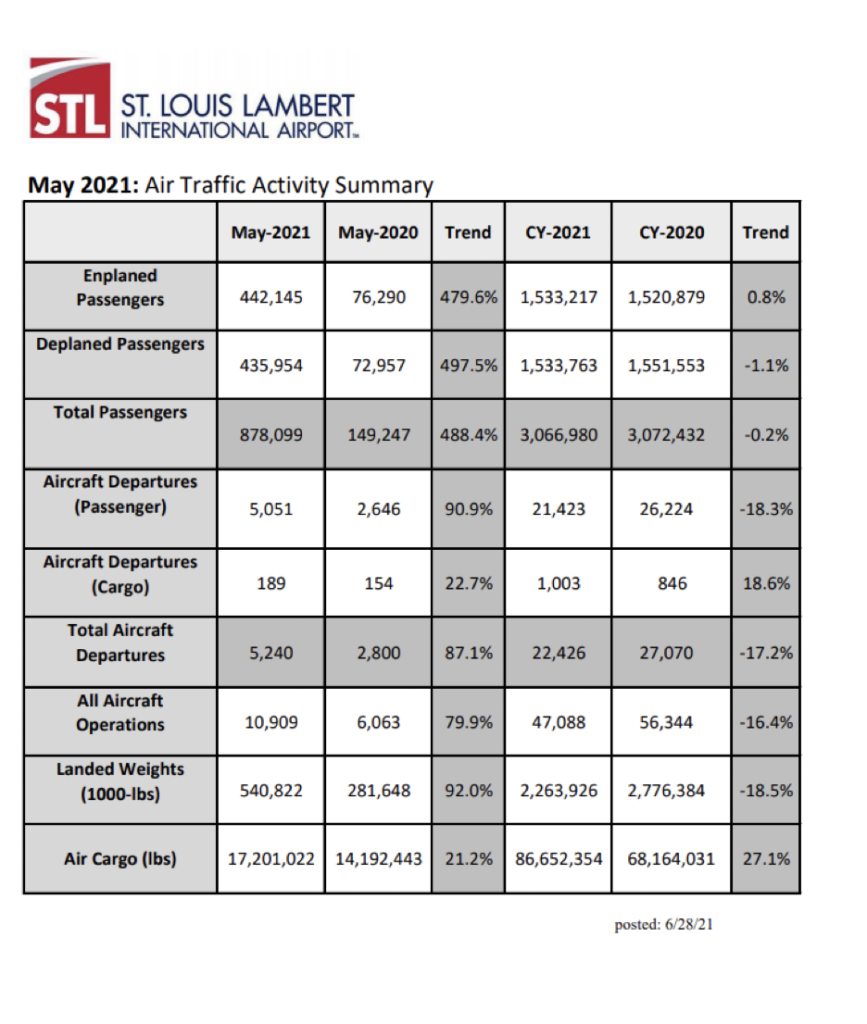

Airport cargo traffic has remained sound. Large logistics firms continue to make significant investments and expand hiring. Other insightful observations made in the FRB report include a childcare contact reporting that enrollment inquiries have increased as employers continue to transition back to working in-person, and an education contact reporting that it has been difficult to secure large quantities of school supplies such as laptops and paper for the upcoming school year.

The following is the monthly and annual comparison of air traffic as of May 2021 at St. Louis Lambert International Airport evidencing the above observations. The month of May 2021 shows a significant increase in passenger counts over May 2020, with the comparison year-over-year nearly even in passenger counts. Air cargo in both comparisons (monthly and YTD) is up over 20%.

Total home sales across the largest District metro areas remain high despite increasing home prices. While the pace has slowed in recent months, FRB contacts remain optimistic that sales levels will hold at current levels throughout the remainder of the year. In St. Louis, the median price for a home increased by 17% and the median price for a condo increased 6.2% compared with a year earlier. Meanwhile, apartment rental prices across the largest District metro areas have risen sharply since this time last year. The median number of days a house is on the market has decreased, reaching as low as 10 days in Louisville, while St. Louis is currently 20 days vs. 40 days during June 2020.

Commercial real estate activity continues to vary across different sectors. Industrial real estate activity has increased strongly, with leasing activity increasing across all the largest District MSAs. Meanwhile, office and retail rental activity continue to face challenges.

Natural resource extraction conditions improved modestly from April to May, with seasonally adjusted coal production increasing 7%. May production was up strongly compared with a year ago, increasing 34%.

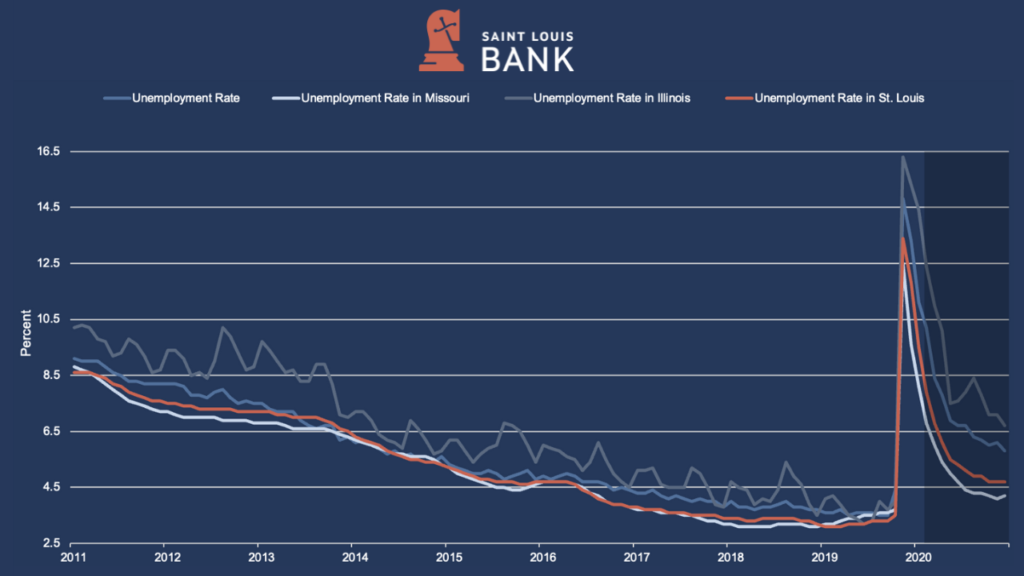

Economic conditions in the St. Louis area have improved. FRB contacts report widespread hiring activity with ongoing challenges finding workers. As of May 2021, the unemployment rate continues to improve with stable-to-decreasing unemployment in Missouri and Illinois.

Unemployment Rate: National, St. Louis MSA, Missouri, Illinois, Seasonally Adjusted. Shaded areas indicate U.S. recessions, the most recent one is ongoing.

Hospitality contacts noted a significant uptick in tourism activity as attractions have returned to full capacity. Some FRB contacts have expressed concern that the increase in COVID-19 cases in Missouri will reduce activity during the remainder of the summer.

Cost pressures in the manufacturing space continue to be an issue, but there have been signs of stability. Mid-size manufacturing firms are most concerned about the compression of profit margins and the need to pass price increases onto customers.

Data Sources: Federal Reserve Bank of St. Louis, The Beige Book, Eight District, July 2021; FRED Economic Data; Deloitte Insights, US Economic Forecast Q2 2021; Air Traffic Activity Report, Updated June 28, 2021, St. Louis Lambert International Airport.

Disclaimer: The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of Saint Louis Bank. Any assumptions made in the analysis are not reflective of the position of any other entity other than the author(s), and since we are critically-thinking human beings, these views are always subject to change, revision, and rethinking at any time. The information contained within has been obtained from sources we believe to be reliable; however, we have not conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. While we do not doubt its accuracy, we have not verified it nor make any guarantee, warranty or representation of any kind or nature about it. The use of or reliance upon and resource provided is a tacit acceptance that the reader understands that the materials may be out of date, opinion-based, incorrect, or biased. It is the reader’s responsibility to verify their own facts.

St. Louis Bank is an Equal Housing Lender and Member FDIC.